Glencore-Merafe suspends additional ferrochrome smelters in South Africa

News Analysis

30

Apr

2025

Glencore-Merafe suspends additional ferrochrome smelters in South Africa

The Glencore–Merafe joint venture has placed its Boshoek and Wonderkop ferrochrome smelters under hot care and maintenance following a strategic review of its South African operations.

South Africa’s ferrochrome sector has long struggled with rising electricity costs, which have increased by 348% (nominal) since 2010. These cost pressures are largely attributed to Eskom’s aging infrastructure and years of underinvestment, particularly during the period of so-called “state capture.” Despite these challenges, producers have managed to maintain ferrochrome output at around 3.3Mtpy in recent years. However, with sustained cost pressure, chrome ore exports have surged, up 346% since 2010, as exporters increasingly pivot away from local beneficiation. With the suspension of furnaces expected in May 2025, Project Blue forecasts a 33% y-o-y decline in ferrochrome output from South Africa, leaving Samancor as the only remaining domestic producer. This could release an additional 3.3Mt of chrome ore into export markets.

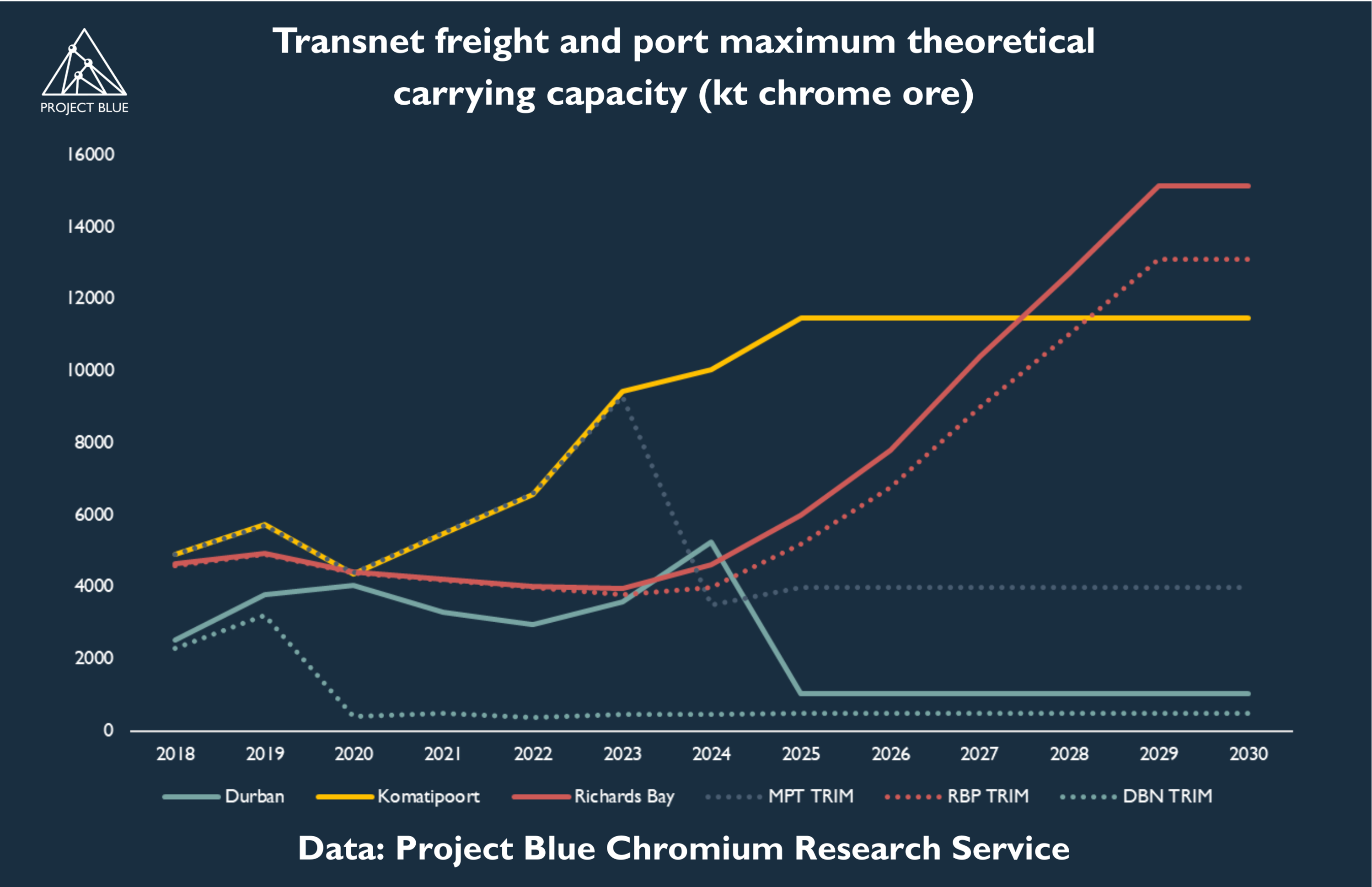

As further producers shift to ore exports, logistics have become the new chokepoint for the industry. While electricity pricing remains the primary bottleneck for ferrochrome, chrome ore exporters face growing constraints from the country’s state-owned freight operator, Transnet. In response, Transnet has issued a request for information (RFI) to attract private sector participation in rehabilitating key rail corridors, particularly those serving bulk ore exports. In the meantime, chrome ore producers have increasingly relied on road transport over rail, trucking material to ports as rail capacity deteriorates. Exports through the Port of Maputo have continued to grow, as Richards Bay and Durban bulk terminals remain congested due to widespread inefficiencies and equipment constraints across the Transnet network.

As part of its turnaround plan, Transnet aims to relocate the chrome terminal from Durban to Richards Bay, with plans to expand Richards Bay’s chrome handling capacity to over 17Mtpy. Rail capacity into the port is expected to increase from 8Mtpy to 13Mtpy, while rail into the Port of Maputo is set to grow from 3Mtpy to 4Mtpy. However, with Glencore shifting its focus towards chrome ore exports in place of ferrochrome, Transnet will be required to handle greater volumes of ore. In its current state, the network is unable to meet producers’ immediate export needs, meaning that more chrome ore is likely to be routed through the Port of Maputo in the near term.