Critical materials at centre of US-brokered peace deal in Central Africa

News Analysis

30

Jun

2025

Critical materials at centre of US-brokered peace deal in Central Africa

On 27 June 2025, Rwanda and the DRC signed a peace deal in Washington DC.

The two countries’ foreign ministers signed an agreement pledging to implement a 2024 deal which will see Rwandan troops withdraw from eastern DRC within 90 days. The two nations will also begin discussing a regional economic integration framework within the same period.

Critical minerals are an important feature of the region, the conflict, and this US-brokered deal:

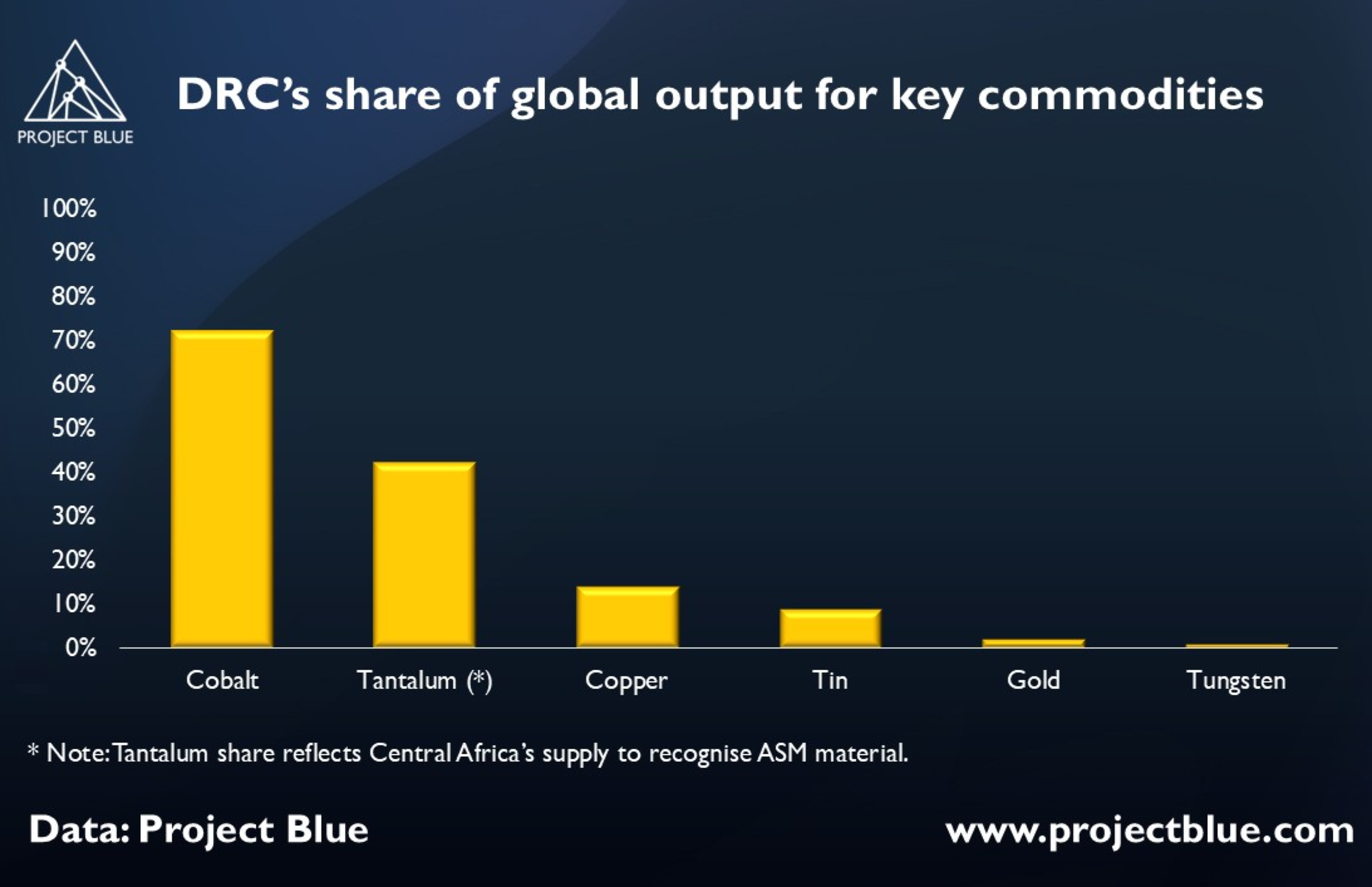

- Eastern DRC has huge reserves of tin, tantalum, tungsten and gold – while other parts of the DRC are rich in other metals including copper, cobalt and lithium. The DRC is a key mining region for many of these metals, and in 2024 produced 72% of the world’s cobalt, 42% of its tantalum and 14% of its copper according to Project Blue data.

- Control over critical mineral resources has led to relentless violence and fuelled armed groups in the aftermath of the decades-old conflict rooted in the 1994 Rwandan genocide. Knock-on effects in the region include entrenched corruption and an undermining of state authority, while international responses have included heightened concerns from a social and business risk perspective in the region, as well as regulatory responses (e.g. the US Dodd-Frank Act Section 1502 on conflict minerals).

- The full agreement has not been released publicly, and the summaries that have been published remain vague. In his statement, President Trump implied that that US had secured lucrative mineral rights: "We're getting, for the United States, a lot of the mineral rights from the Congo as part of it. They're so honoured to be here [in Washington]. They never thought they'd be coming."

There are two key questions that come out of this development.

First, if the agreement does hold, what does it means for the region’s critical minerals development?

The entanglement of peace efforts with mineral interests reflects a long-standing pattern in the DRC’s history. From King Leopold’s rubber and ivory atrocities to colonial-era cobalt and copper extraction, Congolese people have rarely derived lasting benefit from their land’s riches. This is the heart of the DRC’s “resource curse”: where vast natural wealth has yet to translate into national economic wealth due to conflict, corruption, and commodity price volatility.

The DRC and Rwanda now have three months to launch a framework "…to expand foreign trade and investment derived from regional critical mineral supply chains". If designed and implemented well, such a framework could help align diplomacy, development, and resource strategy to support critical mineral supply chains, improve governance in conflict-affected regions, and elevate African leadership in global commodity markets.

By tying mineral access to governance and regional integration, such a framework could shift incentives away from conflict and toward mutual benefit, with the potential to strengthen the case for Africa-wide trade and development, offering a model where mineral wealth supports local industry, clean energy, and political stability.

There will of course be numerous challenges, not least of which is an extremely fragile governance structure in the DRC. Without investment in people, infrastructure, and environmental safeguards, the deal could deepen many structural issues plaguing the country.

Second, would the deal be truly impactful for the USA’s critical minerals sourcing strategy?

It remains to be seen what structure or form of ‘mineral rights’ the USA has secured in the DRC as part of this deal. It brings to mind the Ukraine-US Mineral Resources Agreement signed in April 2025, which is intended to setup a joint investment fund for critical minerals development, but where the risk distribution, timeline to implementation, and critical minerals allocation is unclear.

Nonetheless, the next phase of this deal will assess not only regional cooperation between the DRC and Rwanda, but the broader contest between the US and China for influence over the global critical minerals landscape. Through this deal, which builds on months of discussion between the US government and their Congolaise counterparts, the USA now joins China as a key player competing to secure access to the DRC’s vast mineral wealth and exert influence through economic and political means rather than direct control.

However, China plays a dominant and deeply entrenched role in the DRC’s extractive sector. Since the US$6.2Bn Sicomines ‘Minerals-for-Infrastructure’ deal in 2007, a subsequent mix of state-backed FDI and direct owner-operator business models by non-state-owned Chinese companies has resulted in China securing access to much of the DRC’s (and the world’s) most critical mineral reserves. Project Blue data shows that around 67% of cobalt and copper produced in the DRC in 2024 was under Chinese control.

This US-brokered deal is meant to be seen as another lever to challenge China’s influence in the DRC’s extractive sector. The USA has committed US$1.6Bn to the Lobito Corridor to date, designed to improve the movement of goods from Central Africa to the Atlantic. This is generally viewed as a resolute commitment to the USA’s critical minerals sourcing strategy.

However, other infrastructure programs have not survived, such as the Power Africa Initiative that was shut down in April 2025. The African Growth and Opportunity Act (AGOA), launched in 2000 as a trade preference program to foster economic growth and development in the region, is set to expire in September 2025. Washington’s appetite for renewal remains uncertain within the context of the Trump administration’s protectionist trade strategy. On the other hand, it is possible that the USA signs a bilateral agreement with the DRC, focusing on strategic trade areas of interest such as critical minerals, while leaving multilateral agreements to be concluded amongst other parties, such as in the African Continental Free Trade Area (AfCFTA).

At the end of the day, the success of this agreement will hinge on whether the deal is upheld by all parties – government and non-government alike – and establishes an environment where long-term mineral cooperation can thrive. Part of its success may be driven by the credibility of the USA’s commitment to the region, offering an alternative to China’s concentrated position, but it will take a genuine desire and structural shift in mindset from all the key players inside and outside the region to be sustained.