Glencore to close Mt Isa copper mine and smelter

News Analysis

29

Jul

2025

Glencore to close Mt Isa copper mine and smelter

Glencore recently announced plans to shut its Australian copper assets after six decades of operation. Despite optimal copper market conditions, high operating costs and depleting ore reserves have left the Mount Isa operations unprofitable and “no longer viable”, according to Glencore.

Copper has been a hot commodity over the past couple of years as futures prices have hit new records, reaching US$5.92/lb on the CME, while LME prices have risen by more than 13% since the start of the year to US$4.47/lb in July.

The looming 50% US copper import tariffs, set to take effect on 1 August, further highlight the geopolitical importance of copper and could disrupt the global copper market even further.

Consequently, copper-producing assets have become highly sought after. Project Blue anticipates a 25% increase in copper demand over the next decade, driven by the global shift towards electrification and decarbonisation.

However, supply will remain limited due to an insufficient project pipeline restricted by decades-long permitting and construction timelines.

As one of the top ten producers in the industry, Glencore has been a major beneficiary of rising copper prices, with assets located across Australia, Canada, Chile, Peru and the DRC. Therefore, Glencore’s announced plans to shut its wholly owned 40-ktpy producing Mt Isa mine contrasts with the market’s strong demand for copper assets and comes as a major blow to the local workforce.

In 2023, Glencore stated that the Mount Isa operation was no longer viable due to declining ore grades. Simultaneously, the operation was hit by rising operating and sustaining capital costs as mining activities extended further underground. As of Q3 2025, 88% of the assets in the copper extractive industry exhibited a positive profit margin.

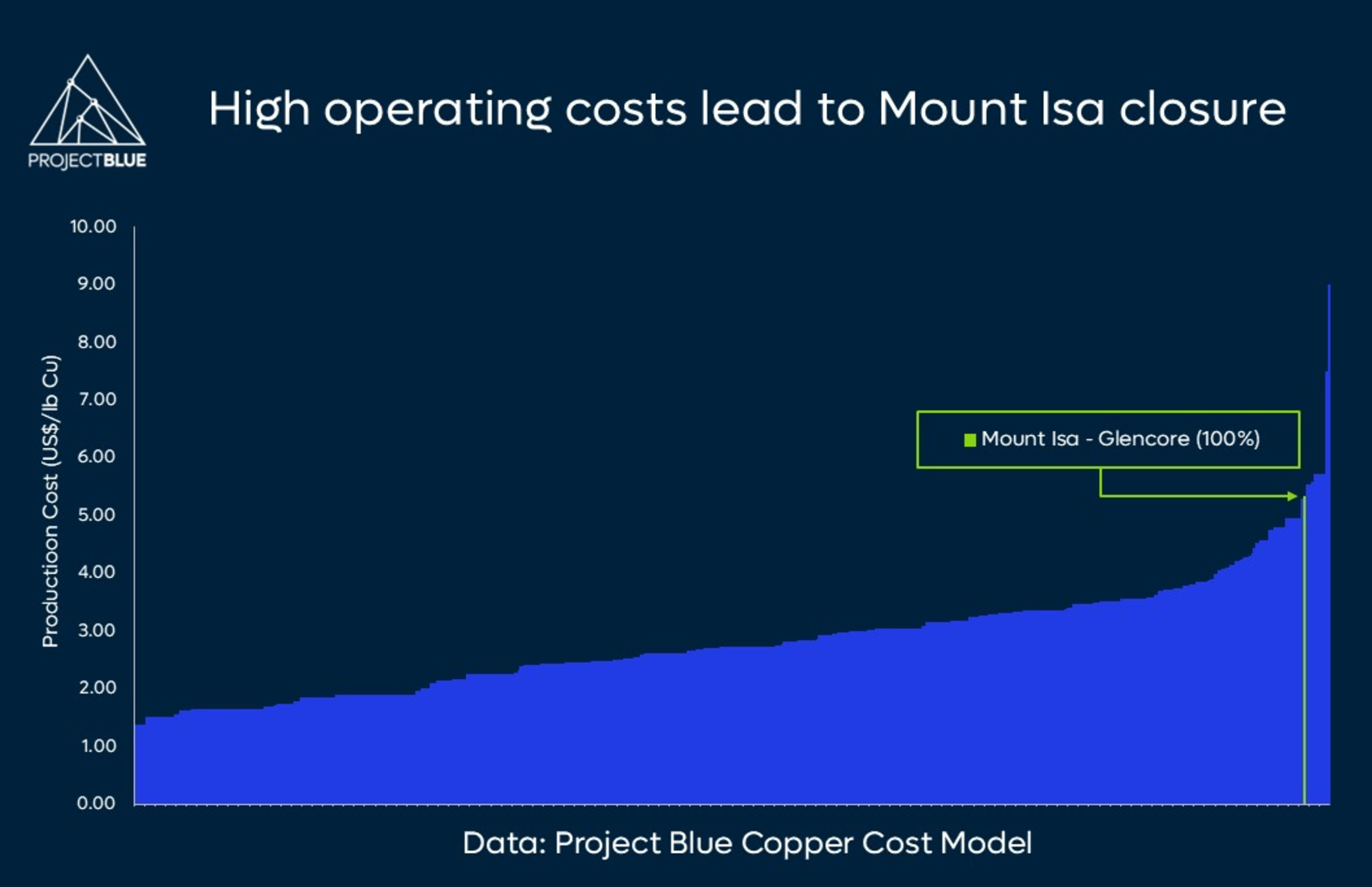

Mount Isa fell within the 12% of assets that are unprofitable, sitting at a negative margin of US$-1.25/lb Cu. The asset’s lack of profitability is due to its high production cost of US$5.33/lb Cu, positioning it in the higher quartiles of the industry cost curve.

While Mount Isa is predominantly a zinc-producing asset, having produced 548.6-Mt of zinc concentrate last year, from a copper standpoint, the asset is nearing the end of its lifespan. As of 2024, the asset held a mere 1kt of contained copper in proven reserves.

Despite high copper prices, Mt Isa’s inability to remain operational is attributed to its high operating cost and minimal reserves, with the zinc segment of the facility unable to provide relief.

However, Glencore has previously announced the closure of the Mt Isa smelter, which was prevented through financial assistance from the Australian government. It may be possible for the smelter to remain open, producing copper anode using third-party feedstocks.