Copper margins: a decade in review

News Analysis

14

Aug

2025

Copper margins: a decade in review

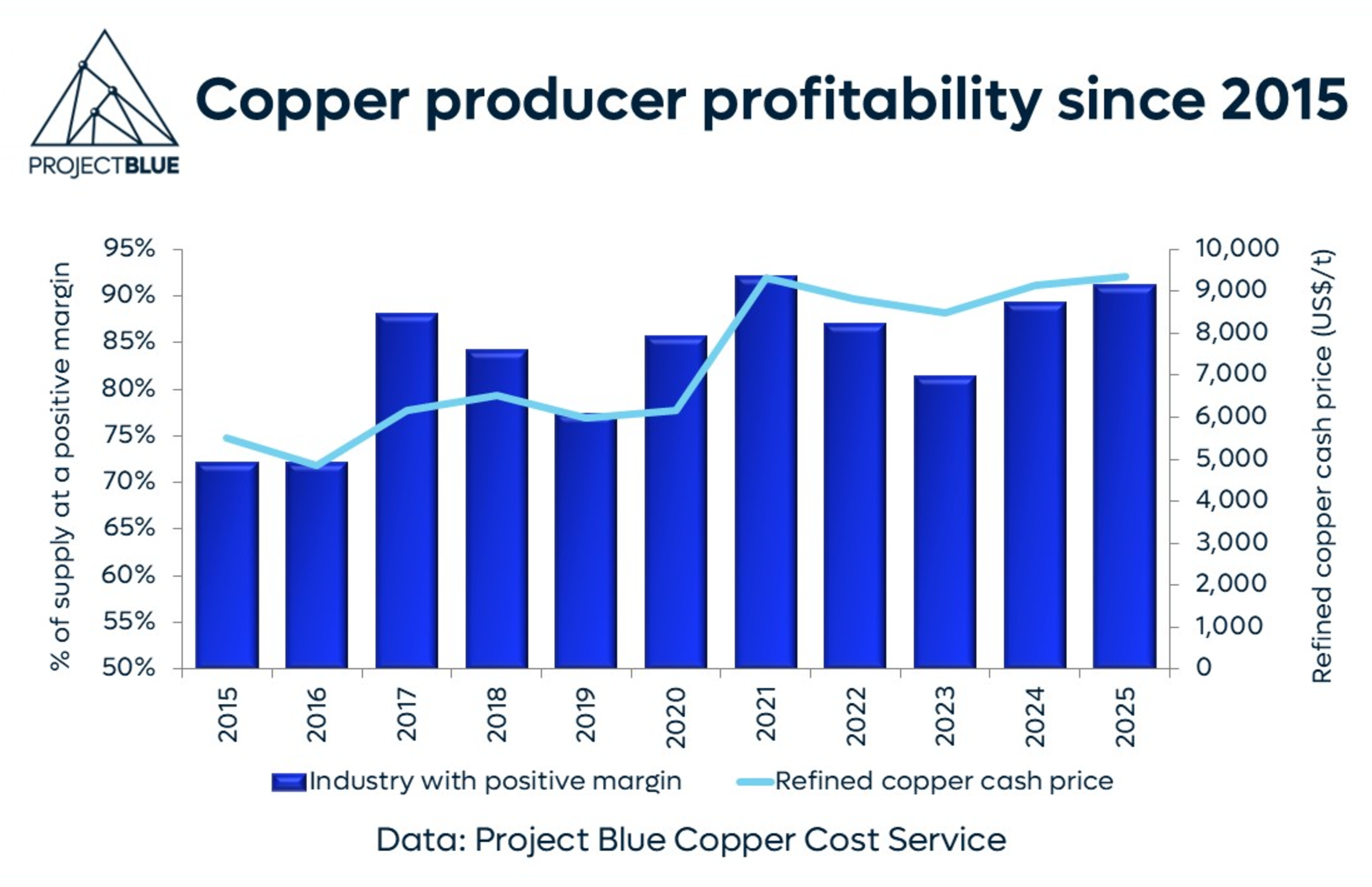

Drawing on data from Project Blue’s Copper Cost Service, our latest analysis examines how producer margins have evolved over the past decade, and which segments of the market are currently capturing the strongest margins.

How have profit margins at copper producers changed since 2015?

Profit margins across the copper industry have risen significantly over the last ten years, according to data from Project Blue’s Copper Cost Service.

Since 2015, industry profitability has steadily improved, driven by higher copper prices and favourable processing economics.

From 2015 to 2016, just 72% of global output was cash positive. In 2017, the share of global copper production operating at or above breakeven rose to 88%.

This improvement was less about expanding margins and more about previously unprofitable operations, particularly in Chile, returning to viability as copper prices recovered.

As of 2025, the outlook has strengthened further, with more than 90% of global production now cash positive, despite ongoing cost inflation.

Who is generating higher margins in the market?

Project Blue’s copper industry margin curve reveals that large-scale concentrate producers continue to generate higher profit margins. Meanwhile, smaller-scale operations mainly account for the bulk of assets operating at negative margins.

The combination of higher copper prices and low treatment and refining charges has further strengthened margins for concentrate producers, as smelters and refiners with excess capacity have driven down processing charges.

At the same time, there has been an increasing appetite towards underground mining, as companies pursue higher ore grades and lower strip ratios. In some regions, this shift has pushed up costs and compressed margins slightly, particularly in parts of South America and Africa.

Meanwhile, SX–EW cathode producers in the DRC and Zambia, who historically have led the margin curve, have seen declining profitability in recent years. These producers once benefited from high cobalt by-product credits with margins peaking during the 2021 price rally.

However, much of the uplift was tied to strong cobalt prices. Since then, cobalt prices have collapsed, weighed down by feedstock oversupply and slowing demand growth from the lithium-ion battery sector.

With by-product revenue falling and production costs rising, margins for SX–EW producers have declined sharply. Consequently, concentrate producers have now overtaken SX–EW producers on a margin basis for the first time in over a decade.

Project Blue's Copper Research Service

Our Copper Research Service provides detailed analysis and long-term forecasts for the copper market to support strategic and investment decisions - speak to our experts to learn more.