How will copper miners be affected by the DRC's cobalt export ban?

News Analysis

3

Sept

2025

How will copper miners be affected by the DRC's cobalt export ban?

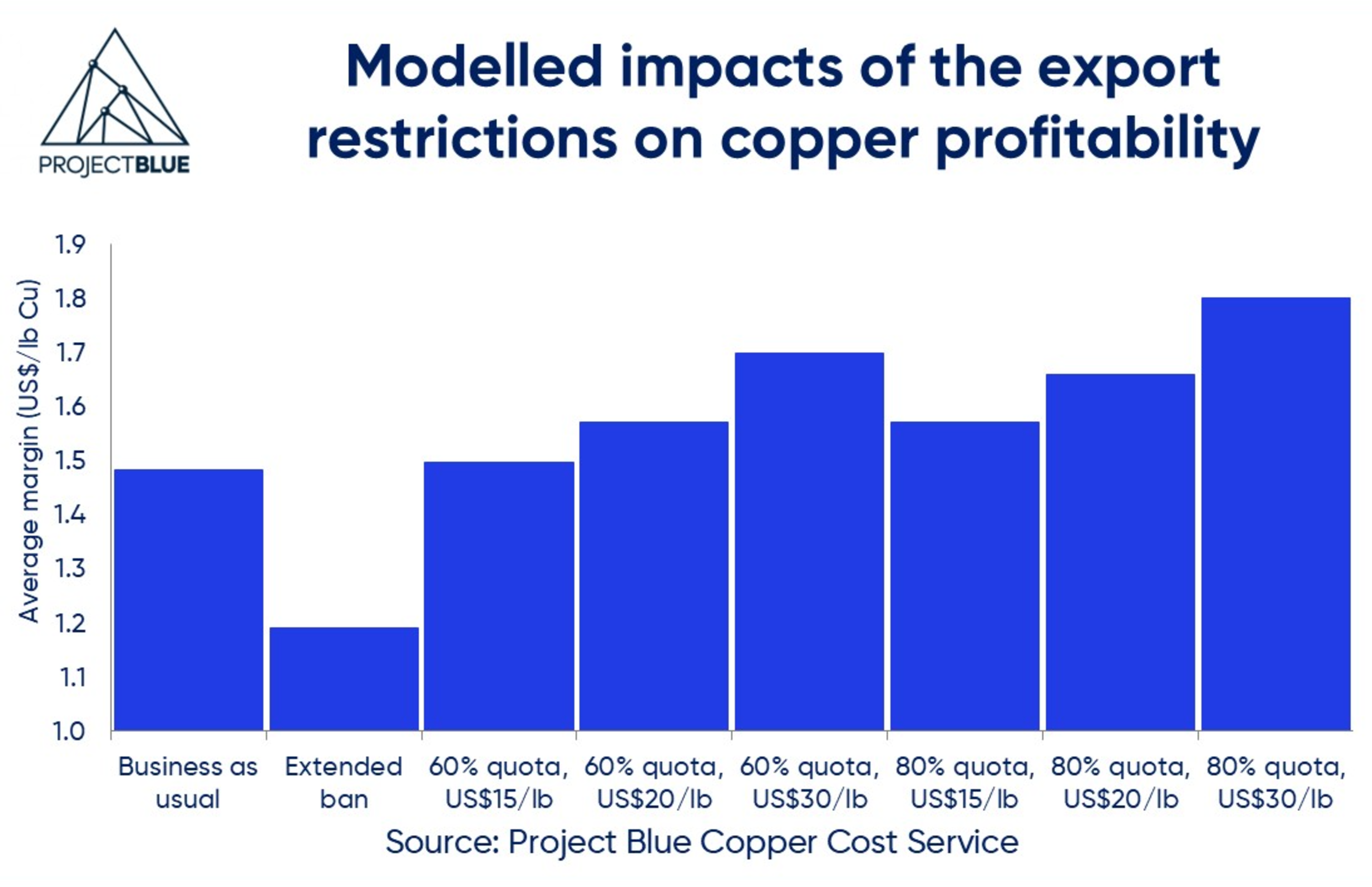

Project Blue has developed eight forward-looking scenarios to assess how potential changes to the DRC’s cobalt export policy might impact copper sector’s profitability in 2026.

The “Business as Usual” scenario

Under this scenario—where no export restrictions are imposed after 20 September 2025 or during 2026 - Project Blue projects that approximately 98% of copper-cobalt operations in the DRC will remain profitable. The average production cost for the DRC copper sector is forecast to reach US$2.50/lb Cu on an all-in sustaining cost basis in 2026.

This outlook is based on the following assumptions:

- Copper price: US$4.20/lb (average)

- Cobalt price: US$11.40/lb (average)

- Cobalt hydroxide payables: ~50% of the underlying metal price

The “Extended Ban” scenario

In this scenario, the DRC extends its cobalt export ban for an additional 12 months beyond 20 September 2025. Under such conditions, profit margins for Congolese copper–cobalt producers could decline sharply, falling to below US$1.20/lb Cu, compared with US$1.48/lb Cu under a restriction-free environment.

The loss of cobalt by-product credits would push more than 10% of producers into negative margins. Smaller operations (with output of less than 100ktpa Cu) and those recently transitioning from open-pit to underground mining are expected to be the most vulnerable, absorbing the greatest impact under this scenario.

Other scenarios

The remaining six scenarios examine how the profit margins of copper–cobalt producers in the DRC may shift under two export quota regimes—60% or 80% of production permitted for export in 2026—combined with three cobalt price assumptions as follows: US$15/lb, US$20/lb, and US$30/lb. In all cases, a 70% hydroxide payability is applied.

Notably, the analysis indicates that copper–cobalt producers may, in certain cases, benefit from cobalt export restrictions. Tighter quotas could support higher cobalt prices, which may partially offset the negative impact of lower export volumes (saleable units).

The results further indicate that while cobalt revenues can provide a meaningful boost to profitability, they are unlikely to fundamentally alter the overall economics of the DRC’s copper sector. Lower cobalt prices, when coupled with stricter quotas, would compress margins; however, the majority of producers are still expected to remain profitable even under restrictive export policies.

It is important to recognise that other variables—such as higher cobalt royalties and fluctuations in cobalt hydroxide payables—can materially impact cobalt realisations and, in turn, copper profitability.

Another significant risk arises from potential logistical challenges once the export ban is lifted. Substantial cobalt inventories may accumulate within the DRC in the near term, and the subsequent movement of these materials to local transport depots could result in severe road congestion. This would likely lead to shipping delays and higher freight costs, further increasing realisation costs for copper producers operating in the region.

Project Blue's Copper Research Service

Our Copper Research Service provides detailed analysis and long-term forecasts for the copper market to support strategic and investment decisions - speak to our experts to learn more.