US and EU germanium prices surge as material remains scarce

News Analysis

4

Sept

2025

US and EU germanium prices surge as material remains scarce

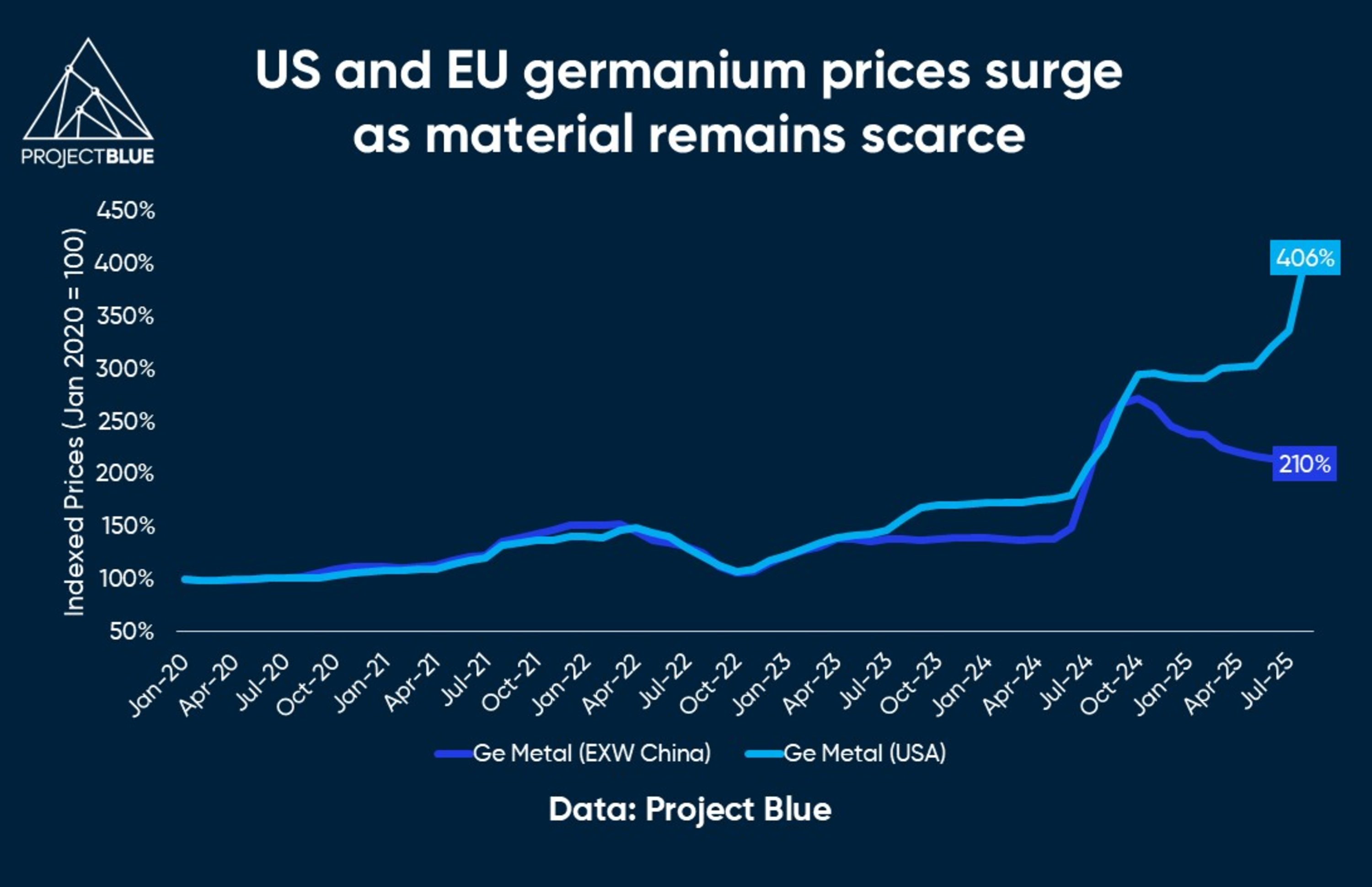

Two years after China announced export restrictions on gallium and germanium products, Western prices for the metal have surged once again, reaching a 25-year high over the past two months.

Germanium prices have increased by more than 33% over the last three months, to over US$4,000/kg Ge in the USA and US$3,955/kg Ge in Europe. This increase follows an initial doubling of prices to more than US$2,000/kg Ge over the 12-month period to July 2024, after the original export restriction announcement in July 2023.

This explosive price development follows a series of export crackdowns in China after germanium material sourced from the country was believed to have circumvented controls and reached the USA despite an outright export ban introduced in December 2024.

Conversely, domestic EXW China prices declined by 23% to US$2,041/kg Ge in August 2025 after peaking at US$2,638/kg Ge in October 2024. Clearly, this represents an extraordinary arbitrage opportunity, which is proving increasingly difficult to capitalise on as Chinese suppliers now require export licences to sell material globally.

Scaling up germanium production is a complex undertaking. Output is heavily dependent on the availability of zinc concentrates or coal fly ash as feedstock. Increasing production requires a greater volume of these materials; however, germanium yield is not guaranteed. Even with consistent input volumes, variations in concentrate quality can lead to volatile recovery rates.

Furthermore, Chinese germanium production is typically more cost-competitive than that of Western operations, a trend reflected in global output data, with China accounting for over 70% of the world’s total germanium supply.

Lastly, expanding germanium production capacity entails significant capital investment. In the absence of long-term offtake agreements, suppliers face considerable risk in scaling operations to meet demand that may ultimately be eroded by market volatility or shifting supply dynamics.

While some industry players outside China have signalled interest in expanding germanium capacity, none of the new projects announced are expected to commence production within the next year.

Notably, Korea Zinc recently announced plans to invest KRW140Bn (US$100M) in the construction of a dedicated germanium facility at its Onsan smelter, with an estimated annual output of approximately 10tpy Ge. This framework project is supported by the signing of a memorandum of understanding between Korea Zinc and Lockheed Martin last week, with the parties expected to begin detailed discussions on a long-term offtake agreement. Trial production is targeted for 2027, with full-scale operation potentially beginning by 2028.

In June 2025, Teck Resources’ Vice President of Communications and Government Affairs revealed that the company was weighing options to expand germanium production at its Trail Operations in British Columbia, Canada, which is supplied with zinc concentrates from the Red Dog mine in Alaska, USA.

Similarly, in 2022, Nyrstar expressed plans to expand its Clarksville zinc plant in Tennessee with the addition of a new 40tpy germanium processing facility. However, the facility has yet to be constructed. Additionally, in August 2025, the federal, South Australian, and Tasmanian governments granted Nyrstar a bailout of A$135M (US$87M) to support the company’s struggling smelters in Port Pirie and Hobart. Using funds granted by the Australian government, Nyrstar will also advance feasibility assessments to produce germanium and indium at these smelters.

Current germanium market dynamics are the result of significant government involvement, especially within the semiconductor industry. Germanium remains crucial in military applications due to its exceptional semiconducting and infrared capabilities, driving up demand.