US Battery Costs and the Importance of Tax Credits

Opinion Pieces

4

Jun

2025

US Battery Costs and the Importance of Tax Credits

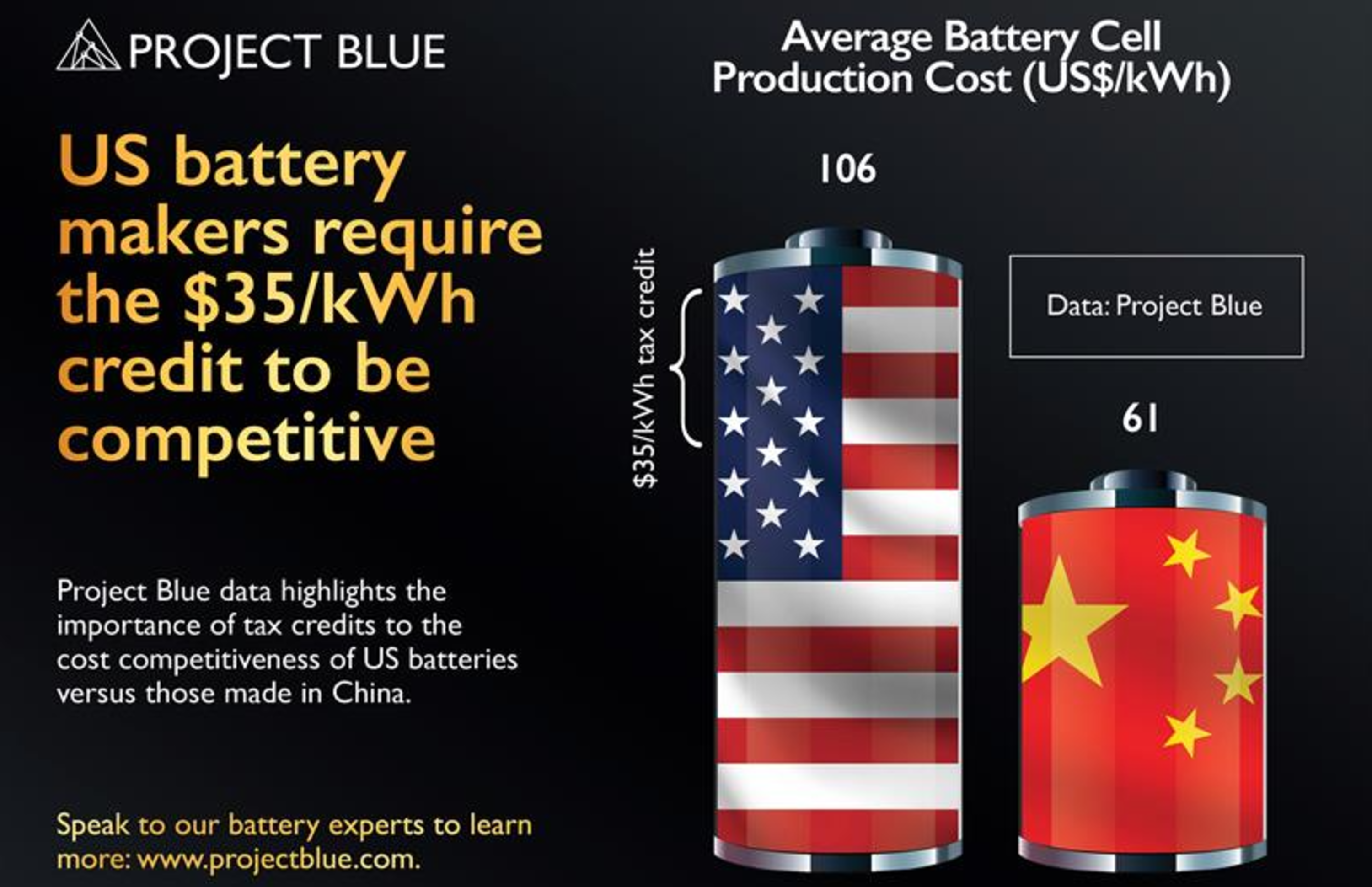

Project Blue data highlights the importance of tax credits to the cost competitiveness of US battery cells versus those made in China.

Amid speculation regarding the future of the Inflation Reduction Act, our global team of battery experts has calculated the average production costs for cells produced in the US and those produced in China, to assess the impact of the current $35/kWh tax credit.

As our graphic above illustrates, the importance of this to the cost competitiveness of US-made battery cells is significant.

Battery production costs have been calculated using Project Blue's exclusive bottom-up cost model that considers all cell components, cell design, electrode design and chemistry composition.

- CAM inputs are calculated from our pCAM and CAM cost model, whilst other components were considered using current pricing

- Energy requirements were applied at the manufacturing step level and labour requirements were applied at the gigafactory level

- Regional CAPEX intensities were used for depreciation calculation in each region and a certain portion of costs attributed to SG&A

The 45X tax credit is still in place after the recent revisions, although projects seeking the tax credits must have begun construction by 31st December 2024.

The amendments to the IRA result in more stringent FEOC requirements, where the project cannot be a specified foreign entity.

Two years after the enactment, the project cannot be foreign-influenced entity or produce components with material assistance from a prohibited foreign entity or subject to a licensing agreement with a foreign entity.

There is also the repeal of transferability after two years for enactment for 45X.