Magnesia’s criticality – has this industry workhorse been overlooked?

Opinion Pieces

10

Jun

2025

Magnesia’s criticality – has this industry workhorse been overlooked?

Project Blue recently attended the MagForum 2025 event in Praia do Forte, Brazil, the first time this flagship conference for the magnesia and magnesium compounds sector has been held outside Europe.

Front and centre of the discussions during the week was the topic of magnesia’s criticality. Despite its use underpinning numerous materials and sectors identified as critical – cobalt, nickel, rare earths, aluminium, copper and steel to name a few – magnesia itself is not listed specifically in any of the critical material studies produced by the USA, EU, UK, Canada, Australia, India, China, or Turkey. However, magnesite is ranked as critical by two of these studies (UK and Turkey) and magnesium metal by five (USA, Canada, EU, Australia and UK).

Building industry resilience

The Project Blue team were delighted to present to conference delegates on recent findings from our Euromines study on the European magnesia sector, including supply risks identified and the interventions and support that industry participants felt would most benefit the sector’s competitiveness.

The Euromines survey participants were asked to rank supportive measures to emphasise the needs of the magnesia industry, with the results showing of most importance was: 1) support towards energy-efficient and low-emissions technology adoption; 2) regulatory support in the form of subsidies and tariffs; and 3) streamlined permitting processes.

Industry resilience was a key topic during the conference as a whole and the room was invited to join in with a live poll by Gustavo Franco, Chief Customer Officer of RHI Magnesita, during his keynote presentation. Nearly 60% of delegates polled said that “diversifying geographic sourcing” was their primary strategy to mitigate supply risk.

China’s magnesia dominance

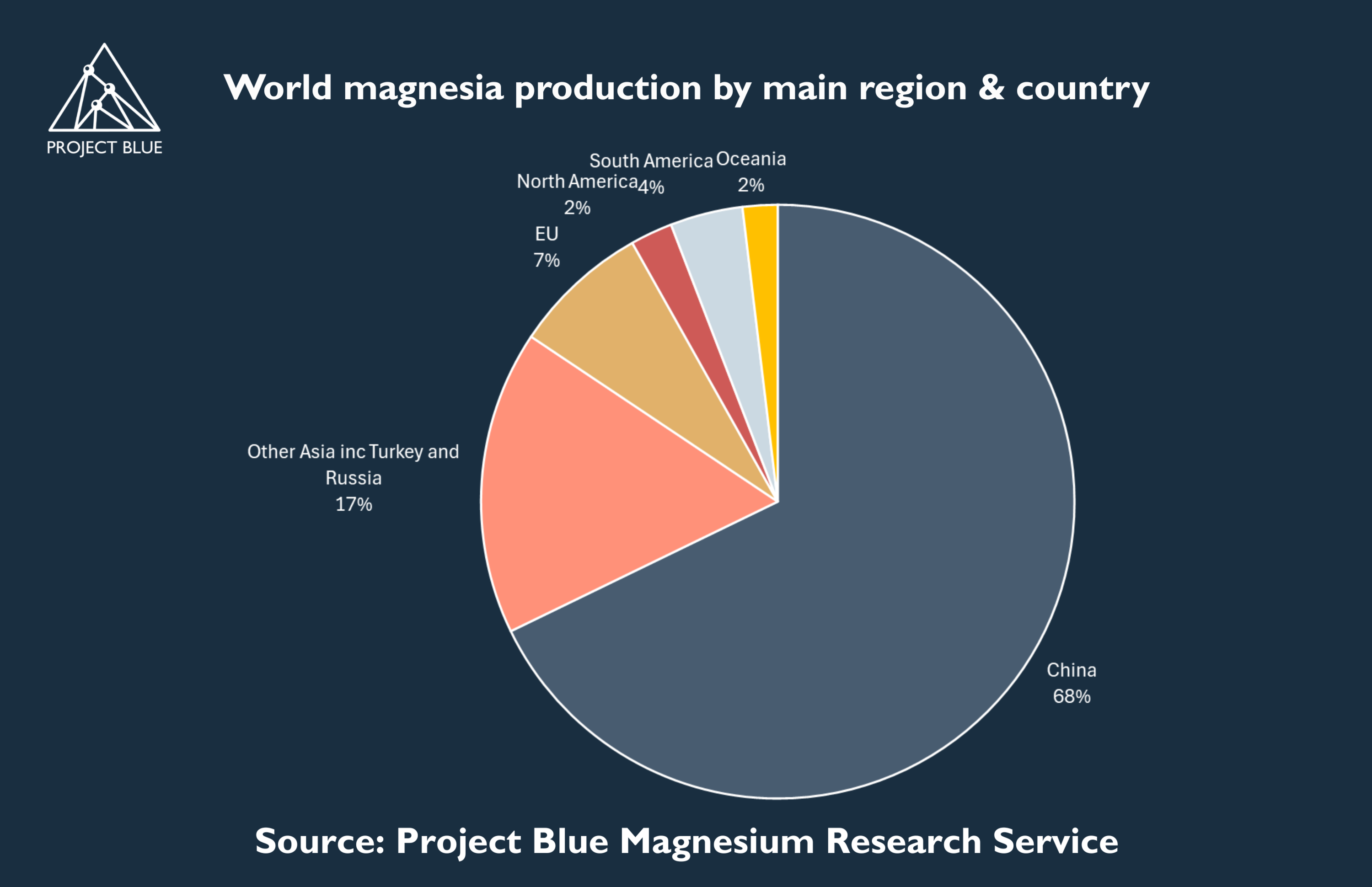

China has long been the leading producer of magnesia with Project Blue data showing it accounted for 68% of global supply in 2024, but excess Chinese magnesia production and capacity has weighed on the global sector and affected profitability.

The provincial government in Liaoning, the hub of China’s magnesite and magnesia sector, has issued guidance to drive industry modernization and consolidation. Already this has vastly reduced the number of magnesite mining enterprises – which dropped from 114 to 63 between 2020 and 2024 – with further consolidation expected by the end of 2025. Magnesia facilities are also being modernized and light-burning reflex kilns for caustic calcined magnesia (CCM) production will be phased out from city areas by the end of 2025.

While such action could help to support industry profitability, the dominance of China in the global magnesia sector seems likely to remain. Given magnesia’s high supply concentration in one country and lack of substitutes in key applications such as refractories for steelmaking, there is a rising belief from some industry participants that magnesia should be recognised as a critical material.

Diversifying supply sources

Following the conference, delegates attended a fieldtrip to RHI Magnesita’s Brumado operations, giving a fascinating insight into company’s capabilities in Brazil.

Brazilian production of magnesia has grown strongly in recent years, with expansion projects implemented by RHI Magnesita (RHIM) and Magnesium do Brasil. South American magnesia production is estimated to have grown by over 20% between 2017 and 2024, reaching nearly 650kt, from a global total of 16Mt.

One such expansion is RHIM’s new rotary kiln in Brumado, which came into operation in May 2024 with a dead burned magnesia (DBM) capacity of 140ktpy. This added to existing multiple hearth furnace and shaft kiln installations, increasing overall capacity there to 60ktpy CCM and 390ktpy DBM.

Brumado is vertically integrated with magnesite feedstock sourced from RHIM’s Pedra Preta and Pomba mines, located within the overall Brumado complex. The new rotary kiln is capable of producing a wider range of DBM grades and accepting a greater variety of feedstocks, including direct lumps of magnesite and briquetted MgO sourced from dust collection systems.

Such expansions point towards Brazil becoming an increasingly important alternative magnesia supply source, particularly at a time when industrial strategies have placed critical minerals at the heart of many governments’ agendas. It remains to be seen if magnesia will officially receive the “critical” status, but it is clear from discussions at the sector’s flagship event that industry resilience is a key concern of many participants.