Guinea’s push towards resource nationalisation and its impact on the bauxite market

Opinion Pieces

25

Jul

2025

Guinea’s push towards resource nationalisation and its impact on the bauxite market

The Republic of Guinea (Guinea) government is altering the dynamics of the bauxite industry, driven by a rising emphasis on value addition, establishing a price index and implementing a new shipping regime. As the Guinean government advocates for enhanced control over its domestic resources, a potential reconfiguration of the global aluminium sector may ensue.

The Guinean government has recently taken strong measures in its domestic mining sector, in revoking over 50 mining licences in May 2025, which has impacted bauxite mining operations. The directive impacts concessions related to five key minerals namely, bauxite, gold, diamond, graphite, and iron ore, awarded from 2005 to 2023, due to non-adherence to development schedules and operational mandates. This action reflects a growing trend of resource nationalism across West African countries and underscores a shift toward value addition. Instead of merely serving as producers of raw materials, these countries are now aiming to manufacture downstream products. In the Guinean bauxite sector, this action is to emphasise the importance of developing alumina refining capabilities and enhancing downstream processes, such as aluminium smelting.

Guinean bauxite’s strategic positioning in the broader aluminium industry

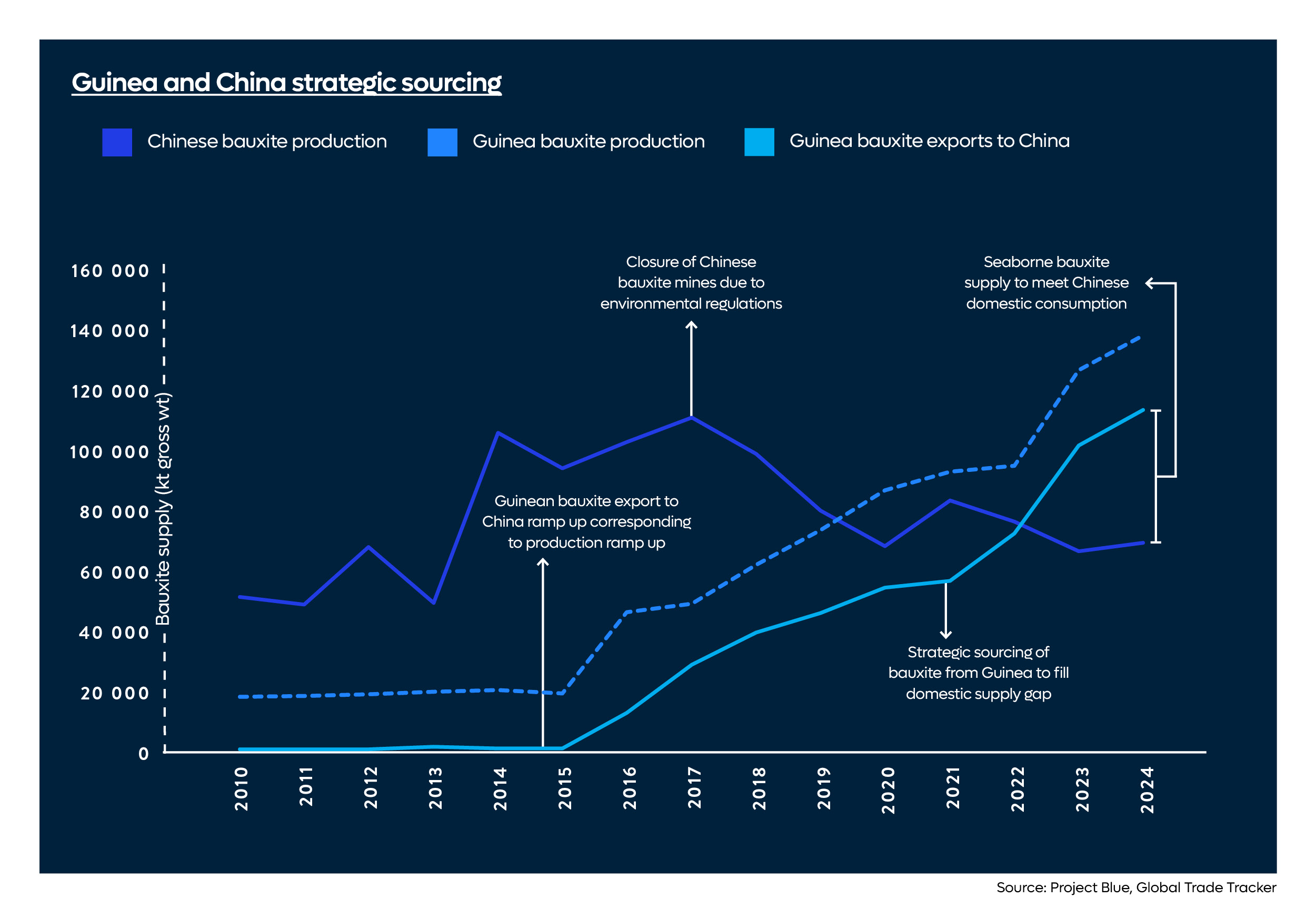

Guinea is the world's leading producer of bauxite, with an output of 135Mt in 2024. Since 2014, Guinean bauxite production has surged from 19.1Mt to 134.7Mt in 2024, marking an incredible CAGR of 21.5%. Bauxite has now overtaken coal to become the second-largest driver of capesize shipping demand globally, with Guinea's rapidly rising bauxite exports playing a significant role in this maritime trend.

However, the recent mining revocations have disrupted bauxite supply, compounded by the rainy season, causing exports to drop from 11.2Mt in April 2024 to 8.8Mt in November 2024. The impact of these mining licence revocations was keenly felt by the Guinea Alumina Corporation (GAC), a subsidiary of Emirates Global Aluminium (EGA), which operates the 11.9Mtpy Boké bauxite mine commissioned in 2019. The impact to supply began in October 2024 when GAC suspended its mining operations and exports due to disputes with the Guinean government over customs duties. The suspension was prompted by GAC's failure to progress with its commitment to build a domestic alumina refinery, leading a significant decline in EGA's bauxite exports and ~2Mt of bauxite inventory buildup at the port of Kamsar.

GAC’s mining licence revocation, and subsequent stoppage illustrates the impact of Guinean bauxite supply on both the bauxite industry and the wider aluminium sector. The suspension not only impacts EGA’s vertical integration in the aluminium industry, given that the Al Taweelah alumina refinery in the United Arab Emirates (UAE) partially relies on bauxite from this mine, but also demonstrates the tightening of Guinean seaborne supply is also likely to lead to a rise in alumina prices. This, in turn could have significant implications for feedstock availability and pricing in the global aluminium market.

New pricing mechanism and shipping mandate established for Guinean bauxite

In a significant policy shift, the Guinean government announced plans for a new pricing mechanism, the Guinea Bauxite Price Index (GBX), in April 2025. This initiative is aimed at maximising the country’s economic benefits from its bauxite exports. The GBX is set to be implemented by the end of 2025 and is designed to enhance pricing transparency while increasing state revenues by eliminating low transfer pricing practices that have historically undermined the value derived from Guinea's extensive bauxite reserves.

In a follow-up development, the government introduced a new shipping mandate in July 2025 that requires 50% of produced bauxite to be transported by vessels that are registered in Guinea and operate under Guinean maritime authority or vessels with similar attributes. The government plans to fully exercise its transportation rights in accordance with mining laws and existing agreements. To facilitate this, it has established the Guinean Maritime Transport Company (GUITRAM), which will be responsible for majority of outbound logistics for bauxite. With the introduction of GUITRAM and the GBX, the Guinean government aims to exert tighter control over seaborne bauxite supply, by asserting its maritime sovereignty. This new shipping regulation is expected to foster greater collaboration between foreign operators and Guinean entities, significantly impacting global dry bulk logistics and freight economics. These measures are likely to reshape both Guinea’s economic landscape and global shipping patterns, especially for capesize vessels, aligning with the country’s long-term vision of developing a comprehensive maritime economy beyond raw material extraction.

As bauxite is now the second-largest contributor to capesize shipping demand, surpassing coal, Guinea’s shipping policies have the potential to influence global freight rates and vessel deployment strategies. In 2024, Guinean bauxite exports reached 123Mt, accounting for over 90% of the nation's bauxite production. Considering that 90% of Guinea’s 2024 bauxite exports were destined for China, this poses implications for the Chinese alumina and aluminium industries, as China is the leading global producer of both materials. This highlights the potential for the Guinean bauxite industry to reshape the broader aluminium market and leverage its position to enhance domestic manufacturing capabilities, though the extent of this potential remains to be fully realised.

What does this mean for the Chinese alumina and subsequently, aluminium industries?

Guinea and China have established a robust partnership as key players in the aluminium supply chain. This relationship has been strengthened by Guinea's significant increase in bauxite production, attributable to the development of Chinese-owned bauxite mines in collaboration with the Guinean government. The most prominent of these is the SMB-Winning bauxite mine, which commenced operations in 2015, adding capacity of 50Mtpy to Guinea’s mining output. Prior to this, between 2010 and 2014, Guinea averaged 18Mt of bauxite production annually.

Following the mine's commissioning, production skyrocketed by 146% year-on-year in 2016. This surge coincided with bauxite export bans in Indonesia and Malaysia, which constrained international supplies and prompted China to diversify its bauxite sources. As a result, Guinean bauxite production reached 26Mt in 2016 and doubled to 42.7Mt in 2017.

As production in Guinea continued to grow, exports to China surged as well. The closure of several Chinese bauxite mines in 2017, due to environmental regulations further pushed China to seek outsourcing options for its bauxite supply, leading to increased imports from Guinea. Consequently, Chinese imports of Guinean bauxite have consistently followed an upward trajectory since.

With the Guinean government only announcing the implementation of the GBX in April this year and mandating that 50% of all produced bauxite should be exported by Guinean vessels, the measures have yet to fundamentally impact the bauxite market, although there was a slight increase in prices following the revocation of mining licences. Market uncertainty could, however, create volatility if investors fear escalation to larger operations. The long-term implications of these initiatives deserve close attention, as strict enforcement could lead to higher production costs and upward pressure on bauxite prices. Numerous bauxite mines in Guinea are partially owned by Chinese companies, raising questions about the feasibility of enforcing these regulations, especially given the Guinean bauxite industry's dependence on Chinese investment.

Additionally, Guinea’s minimal alumina refining capacity poses a challenge, as restrictions on bauxite exports could lead to oversupply. There is a risk that the Guinean government may unintentionally undermine its domestic bauxite industry, similar to Indonesia after its 2014 bauxite export ban aimed at encouraging domestic processing and value-added production.

The Guinean government has presented justifications for changes within the bauxite industry alongside other mineral industries, citing resource optimisation and value addition for economic development. The country's bauxite reserves hold a strategic importance because of their contribution to global aluminium production. Guinea's current initiatives reflect an intentional strategy aimed at reinforcing national control over its minerals to maximise the economic benefits of its mineral wealth.