Will developments in China drive tungsten prices to new highs in 2026?

Opinion Pieces

12

Feb

2026

Will developments in China drive tungsten prices to new highs in 2026?

Tungsten prices have been rising for many years, and average yearly prices have more than doubled since 2020. With market participants questioning whether prices will rise even further in 2026, Project Blue’s experts examine the key drivers and share their insights.

Tungsten is a critical material used in a range of end-use sectors, including the automotive, mining, aerospace, and defence sectors. The price surge in recent years has predominantly been related to developments in China.

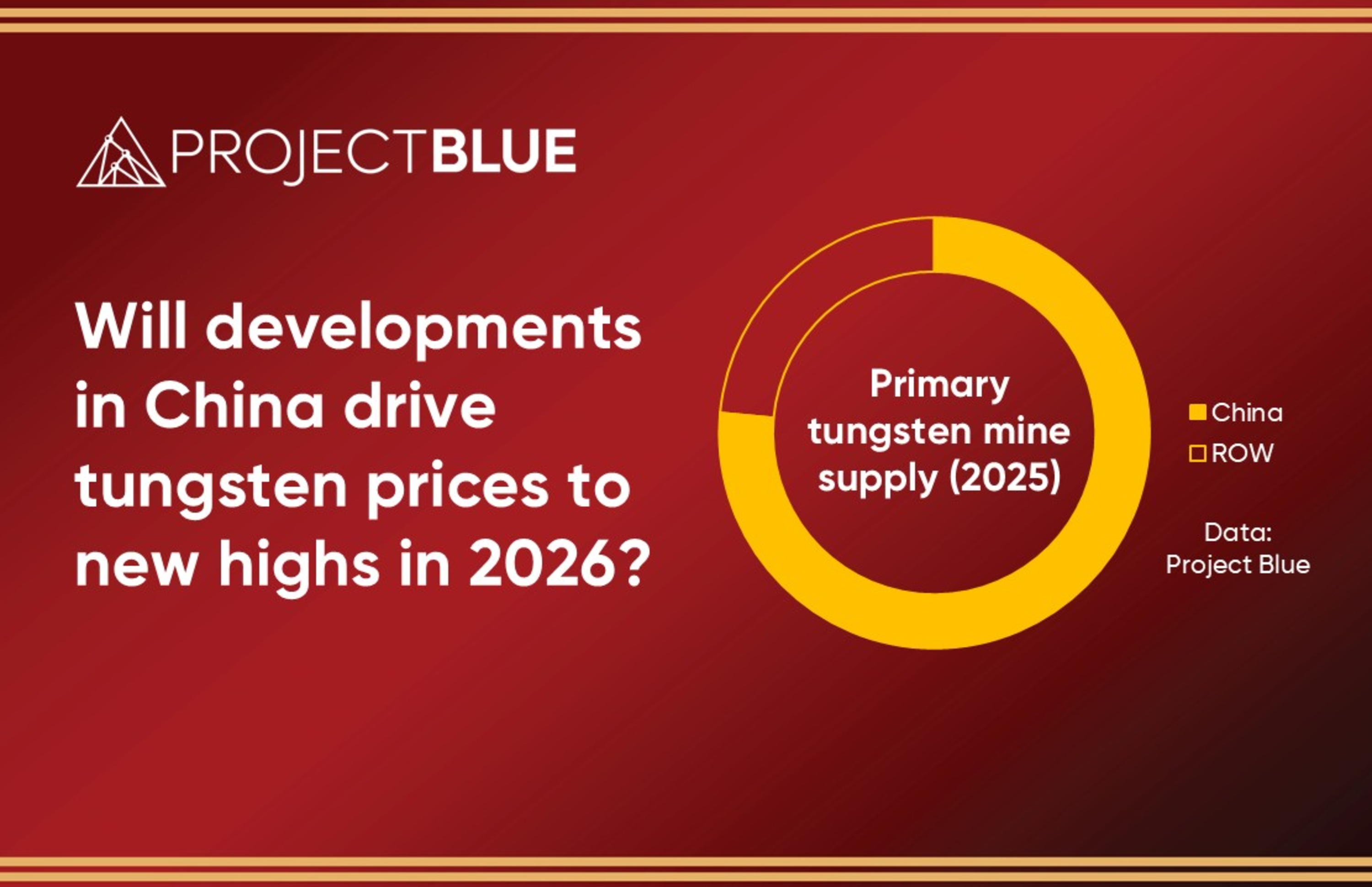

China accounted for over 75% of primary tungsten mine supply in 2025; therefore, developments in China have a strong impact on prices globally.

Declining supply – Project Blue estimates that Chinese mine supply declined by 10% in 2025 vs 2024, owing to ageing mines, lower ore grades, and increased production costs. We expect this trend to continue in 2026, as little investment in exploration has taken place within China.

Mine suspension – Towards the end of 2025, several small and medium-sized tungsten mines in China's key producing areas were suspended after failing to meet the government’s environmental and safety checks. It is unclear when production could begin again.

Production quotas – the H1 2025 quotas issued by China’s Ministry of Natural Resources specified 58,000t WO3, representing a 6.3% y-o-y decline. The H2 quotas were not released and are unlikely to be made public in the future, further adding to supply tightness.

Project Blue expects the challenging mine supply environment in China to persist into 2026, with limited new supply entering the market.

While some sources of ex-China supply are set to increase production, it may not be enough to bridge the supply–demand gap in 2026. China itself is increasingly importing tungsten ores and concentrates from overseas, totalling 6.9kt (gross) from Kazakhstan since the Boguty mine came online in April 2025 and ramping imports from Myanmar up by 114% between 2024 and 2025, reaching 5.2kt gross.

With China’s supply declining and demand continuing to grow, supported partly by tungsten's use in military and defence applications, prices are expected to remain at higher levels this year.